Graphic types in Forex: Linear, Japanese columns and candles

Graphic types in Forex: Linear, Japanese columns and candles

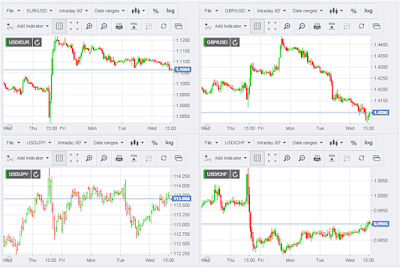

In Forex, like any other investment market, there are three main ways to view market movement and prices: linear charts, Japanese columns and candlesticks are tools that facilitate the trader's understanding of the behavior of any currency pair over a given period of time.

Linear charts: The simplest types of price charts

Linear graphing is very easy to understand or interpret by looking at it, but unfortunately it does not offer much of the important information compared to the other two. It only draws lines between the closing price and the next opening price on a given time frame.

|

| Graphic types in Forex: Linear, Japanese columns and candles |

For example, if you assume that the EURUSD is trading on the hourly frame and that the price moved during that period from 1.1500 to 1.1530, then it dropped to 1.1480, then rose back to 1.1503. In this case, the market witnessed sharp fluctuations during this hour, but the chart will only show a 3-point change (from 1.1500 to 1.1503).

The above example may not be repeated much in the market, but in general the use of the linear graph is not currently widespread because of better alternatives - Japanese column and candle designs. For this reason, the use of linear fees is limited to TICK pricing schemes, which detail the price change by one point at a time a second, but this type is not usually available on all platforms.

Column Chart: Get all the information you need

The graph in columns may be more difficult to interpret than Japanese candlesticks, but it provides more information about the direction the currency pair is taking over any time frame, as shown in the picture below:

On the left side, the small horizontal police point to the opening price, and the police on the right side to the closing price; the beginning and end of each column tells us the top and bottom of the time frame. In order to maximize the clarity of the column chart, the closing price in the left column will be at the same opening price level in the next column. In the same logic, the opening price will be in the right column directly at the same closing price level in the current column. There are exceptions to this rule due to the emergence of price gaps in the Forex market.

Japanese Candlestick Charts: Same information, but in color format

The Japanese Candlestick chart displays the same information as the column charts, but more easily the graph can be interpreted by looking at it with the naked eye. See the image below:

As can be seen from the previous picture, the candlestick chart is more simple than the column charts thanks to the candlestick on the chart. The narrow column from the opening price is drawn to the closing price and is assigned a certain color according to the order of these levels - in this example the green indicates a bearish market while the white indicates a bullish market.

Most traders now prefer to use Japanese candlesticks because they tell them from one look all the information they want about the market in the past hours or days. However, there is no objection to using column charts instead of Japanese candles if you feel more comfortable with them.

No comments: